Publications & Accepted Papers

Engineering Lemons

Journal of Financial Economics, Volume 142, Issue 2, November 2021, Pages 737-755.

Paper, Online Appendix, SSRN Preprint, Video, Coverage by Alpha Architect

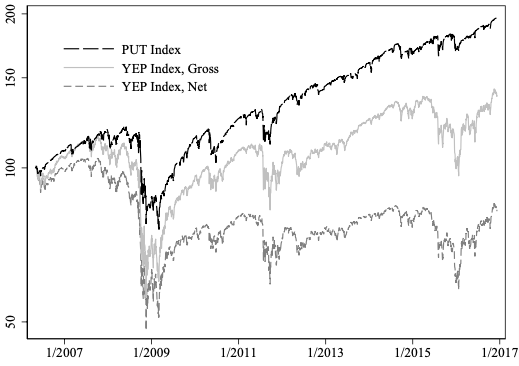

Abstract: Recent complex financial products sold to households contradict the basic premise of canonical innovation theories: financial innovation benefits its adopters. In my 2006–2015 sample of over 28,000 yield enhancement products (YEP) the securities offer attractive yields but negative returns. The products lose money both ex ante and ex post due to their embedded fees: on average, YEPs charge 6–7% in annual fees and subsequently lose 6–7% relative to risk-adjusted benchmarks. Simple and cheap combinations of listed options often statewise dominate YEPs. Competition, disclosure, or learning do not eliminate this inferior financial innovation over my sample period.

Growth Forecasts and News About Monetary Policy

with Nina Karnaukh, Journal of Financial Economics, Volume 146, Issue 1, October 2022, Pages 55-70.

Paper, SSRN Preprint, Orthogonalized MP shocks

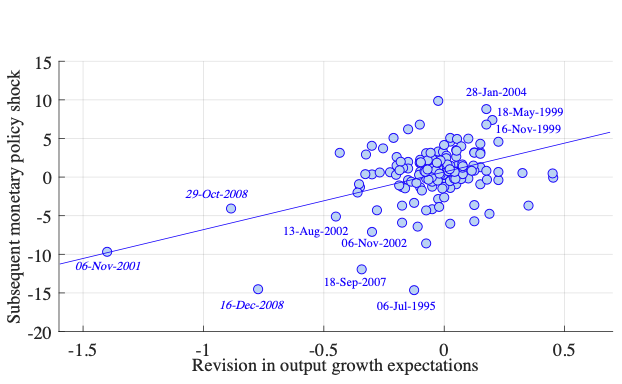

Abstract: We find that 30-minute changes in bond yields around scheduled Federal Open Market Committee (FOMC) announcements are predictable with the pre-FOMC Blue Chip professionals’ revisions in GDP growth forecasts. A positive pre-FOMC GDP growth revision predicts a contractionary policy news shock (positive change in bond yields), a negative GDP growth revision predicts an expansionary policy news shock (negative change in bond yields). Failing to account for this predictability biases the estimates of monetary policy effects on the economy. First, the Fed’s information effect dissipates as the truly unpredictable policy news shock does not affect professionals’ beliefs about the economy. Second, net policy shock has a more negative impact on actual future GDP than the raw policy shock.

Labor income response relative to year before joining

Household Responses to Phantom Riches

with Samuli Knüpfer, Ville Rantala, and Erkki Vihriälä, Conditionally Accepted at Review of Financial Studies

November 2024 | SSRN Working Paper

Abstract: We study the consequences of investment fraud victimization using unique administrative data on Ponzi scheme investors. A matched control event-study design shows that the victims experience a 6% annual labor income loss. Income first declines when an investor joins the scheme, consistent with distorted beliefs lowering labor supply. The scheme’s collapse triggers a further decrease, which we attribute to financial stress caused by the collapse. Investors also face higher indebtedness and tilt their portfolios away from delegated investments. The income loss persists in the long run, equals twice the direct investment loss, and substantially adds to the social cost of fraud.

Working Papers

Democratizing Private Markets: Private Equity Performance of Individual Investors

with Cynthia Balloch, Federico Mainardi, and Simon Oh

June 2025 | SSRN Working Paper, Slides | Coverage by SEC Commissioner Uyeda

Abstract: Using new data on wealthy U.S. households, we provide the first systematic study of private equity performance by individual investors. We identify two innovations that democratize access to private equity: the proliferation of funds with low minimum commitments and pooling capital via advisors. Contrary to concerns about poor performance, we find that aggregate individual investments in private equity perform similarly to institutions and outperform public markets. In the cross-section, the most affluent investors outperform the less affluent by 6 to 10 percentage points in public market equivalent. We show that advisor skill is more likely to explain the performance gap rather than preferential access. Using both observed and simulated intermediary fees, we show that fees impose a sizable drag on performance, especially for less affluent investors.

Conferences: Western Finance Association; RCFS Winter Conference; Columbia PE Conference; Aalto Institutional Investor Conference (Helsinki); IPC Alternative Investments Conference & Spring Research Symposium 2025; 12th Annual Conference on Financial Market Regulation (SEC); Private Capital Symposium (LBS); UT Dallas Finance Conference; Finance, Organizations and Markets Conference (USC); 2025 Private Firm Symposium (U Chicago); UBC Winter Finance Conference; Loyola Wealth Management Conference; Mid-Atlantic Research Conference

Juicing the Coupon Yield: How Banks Extract Rents from Behavioral Biases

July 2025 | SSRN Working Paper

Abstract: The fees on yield enhancement products increase strongly with coupons, despite minimal pass-through of coupons to returns. As a result, higher coupons paradoxically lead to lower net expected returns. Demand estimates exploiting pricing shocks show investors pay over 35 basis points for one percentage point of coupon. Banks engineer coupons using exotic, hard-to-value options that artificially increase coupons, but much less so returns. These patterns are inconsistent with standard reaching-for-yield models and instead point to investor inattention to shrouded attributes. I show that the resulting rents extracted by banks are several times larger than those documented in other financial markets.

NFA 2023 Best Paper Award in Asset Pricing and Market Microstructure

Conferences: AFA (San Antonio), NBER Behavioral Finance, CEPR Workshop on Household Finance, Finance Down Under, Virtual Derivatives Workshop, HEC-McGill Winter Finance Workshop, SGF, MFA, WAPFIN @ NYU, CFPB Research Conference, NFA, CDI

Household share in cross-sectional volatility

DO HOUSEHOLDS MATTER FOR ASSET PRICES?

with Carter Davis, Samuli Knüpfer, Jens Soerlie Kvaerner, Bahar Sen-Dogan

March 2025 | SSRN Working Paper | Slides

Abstract: Contrary to the common assertion that households have little impact on stock prices, we find their importance is of first order. We quantify their impact using an asset-demand system applied to the complete ownership data for all Norwegian stocks over 2007--2020. Households are the most important contributor to stock market volatility relative to their market share. Even in absolute terms, they come second, surpassed only by institutional investors. Our granular data on households reveal a strong factor structure in household demand: The demand of the rich is distinct from less affluent investors, accounts for the bulk of volatility attributable to households, tilts away from ESG, and is informative about future fundamentals. We conclude by quantifying key frictions preventing other market players from absorbing household demand shocks.

Conferences: CEPR European Conference on Household Finance (Stockholm), European Finance Association, Midwest Finance Association, Northern Finance Association

Investments TARGETS AS REFERENCE POINTS

with Aleksi Pitkäjärvi and Matteo Vacca

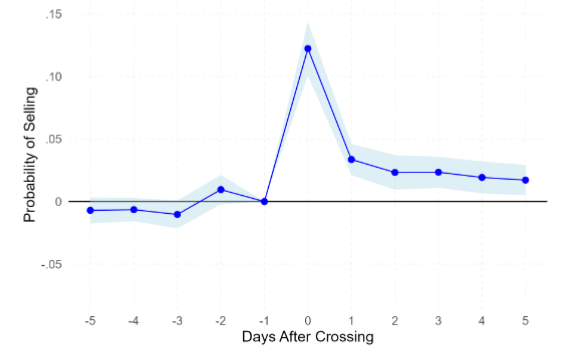

Abstract: We provide the first evidence of forward-looking reference points in investor behavior. Combining administrative data on option traders with a stacked difference-in-differences design, we show that investors’ propensity to sell options spikes precisely when the underlying asset crosses the strike price, which retail investors frequently select to match their target price. The effect is difficult to explain using the standard disposition effect, nominal returns, salience, option Greeks, or complex option trading strategies. Moreover, the effect is present only for options bought out of the money, for which the strike price acts as a natural target, but absent for options bought in the money, for which it cannot. The evidence is most consistent with investors evaluating gains and losses relative to a forward-looking target, in sharp contrast with the backward-looking purchase price widely used in the disposition effect literature. Our findings help reconcile conflicting empirical evidence on investors’ reluctance to realize losses.